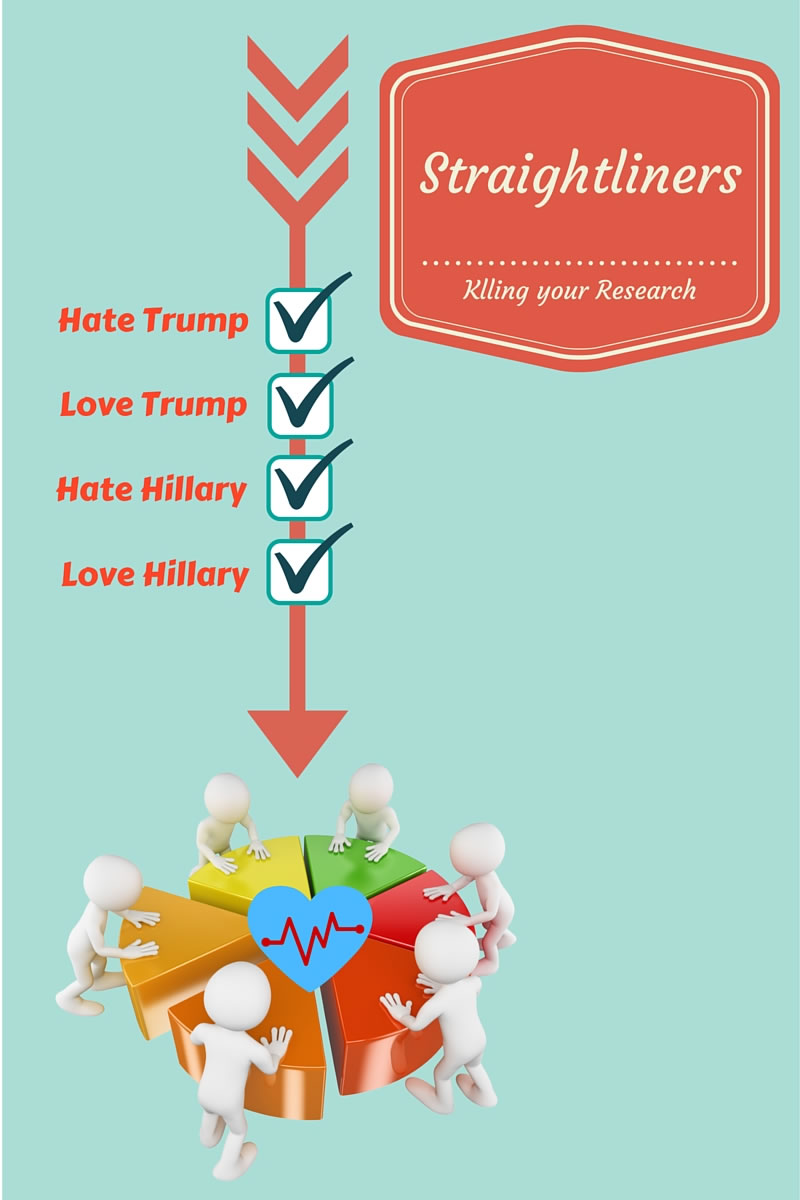

Straightliners (also known as speeders) are an inevitability in market research.

In an environment of online surveys, paid panels, and overly wordy survey questions, it’s no surprise that data quality suffers from respondents filling in surveys without reading them. The result is often surveys answered in a straight line or similar pattern, thus the term ‘straightliners’. The potential outcome of random answers is obvious – the research might turn out inconclusive or worse, based on false data, resulting in big cost to the client and a reputation ding for the researcher.

Labeling paid surveys in marketing research a “double-edged sword,” authors Neafsey and Lang produced a paper for the 2011 SAS Global Forum entitled “Consumer Data Analytics: The Good, the Bad, and the Possibly Deceptive.” In it, they acknowledge the growing trend of companies that resort to buying samples for their surveys from large panel houses, and the resulting analytic challenges that creates, particularly an increase in straightlining and duplicate responses.

So how does a researcher mitigate this risk? While it might be impossible to avoid these types of respondents altogether, here are five solutions every researcher should know to preserve response quality:

1. Be very selective in what sample source you use.

The best source would be your own maintained panel. If this is not possible and you have to seek outside paid panels, keep in mind that cheaper is not always better. An outside paid panel is more likely to produce respondents who have learned to play the system and avoid getting caught, especially if the panel was put together through widely advertised recruitment efforts.

2. Avoid respondent duplication.

According to Neafsey and Lang’s research, identifying those respondents who intentionally fill out multiple surveys to increase their reward can be tricky – but it is possible. Although these respondents tend to use multiple email addresses, locating similar patterns of random responses can help researchers weed out the false data. One of the best ways to mitigate this risk if you are using multiple sample vendors is to have one vendor be responsible for sending emails. That vendor should also be responsible for removing duplicates by locating similar patterns among respondents.

3. Word your questions so they resonate with respondents.

If a respondent doesn’t understand the intent of the question, either through vague wording or overly long copy, they may be tempted to fill in random responses out of simple confusion or frustration. This is why it is important for the survey writer to create survey questions that are conversational in tone, and less like an interrogation or a quiz given by a professor.

4. Avoid long questionnaires.

Long, wordy questionnaires are the primary reason behind respondent fatigue. Even the most interested respondent will have a difficult time staying alert on a 100-page survey, resulting in bad data that could have been avoided with a shorter questionnaire. So what is the best survey length to ensure more accurate data? While there is not an easily quantifiable number that fits all segments of respondents, as a rule of thumb, once you go over 15 minutes, you are likely to see a steep decline in data quality when there are no incentives attached to the survey.

5. Insert a “Check Question.”

A “check question” is one of the best controls for researchers when looking at survey data. This is a question that can be placed once, somewhere in the middle of your survey, to ascertain data integrity and quality. It should be something simple, such as: “If today is April 1st, 2016, what day of the week is it?” If the question is answered incorrectly, it’s a good indicator that the rest of the responses are not quality data.

Click here to see some of the data quality features we have that mitigate many issues related to straightliners.